It is hard to come up with words that are strong enough to describe what an appalling display of misguided ego, inept negotiating postures, bad policy thinking, and utter disregard for the public interest are on display in [the debt ceiling] fiasco. But as a friend of mine likes to say, “Things always look darkest before they go completely black.”

Month: July 2011

It’s Congress that does the spending. The president is prohibited to do that. If he had the power to do that he would effectively be a dictator. There would be no reason for Congress to even come to Washington, D.C. He would be making the spending decisions … Clearly that’s unconstitutional.

Every now and then something true slips out of the GOP’s fetid maw. But, by all means, let’s pretend Obama and his “blank check” are what caused the current entirely invented “crisis.”

CNN’s headline for this small story? Why, of course it’s Bachmann Warns of ‘Dictator’ Obama. What other choice did they have?

In short, the Boehner plan would force policymakers to choose among cutting the incomes and health benefits of ordinary retirees, repealing the guts of health reform and leaving an estimated 34 million more Americans uninsured, and savaging the safety net for the poor. It would do so even as it shielded all tax breaks, including the many lucrative tax breaks for the wealthiest and most powerful individuals and corporations.

Said it approximately one billion times: this isn’t some side affect. It’s the intended consequence. The debt ceiling is simply a useful construct for ramming the same old policy of “zero social safety net, all wealth and benefits to top 2%” GOP dream government setup. All it is, was, or ever will be. If they fix the debt ceiling this morning, they will be using the next federal budget (which will need to be done to have a government post-September) to push the exact same line by this afternoon.

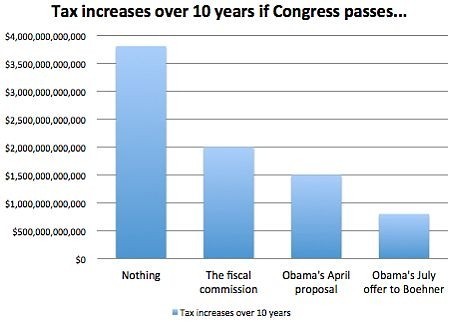

The GOP does not care about deficits. If they did, they’d have taken any of the four increasingly huge deficit cutting plans offered them. They want low to nonexistent tax rates on the top 2%. Simple arithmetic will show anyone that this means eliminating the social safety net; as Ezra Klein has noted: the federal government is better thought of as an insurance conglomerate with a large standing army. To cut taxes to “GOP preferred” levels, services have to go. And to get rid of those hugely popular and helpful services, a large number of people using them have to be convinced said services (and government in general) aren’t working or even in their interest at all. This is the core GOP governing strategy in fifty words or less. Everything they have done and said in the past several decades of tight, lockstep messaging with the aid of the most popular “news” network on television has been aimed at and in service of making those 48 words reality.

Everyone not already up the ladder will kindly go die in the streets. Today they’re using the debt ceiling, tomorrow it will be the FY2012 budget, the next day it will be veterans benefits or whatever else comes to hand. And until they are forced to pay a steep political price for steadfastly using gridlock and economic hostage situations as a negotiating strategy, they will continue to use them. That Congressional and Executive Democrats seemingly haven’t figured this out yet is why they fail.

I really don’t understand how bipartisanship is ever going to work when one of the parties is insane. Imagine trying to negotiate an agreement on dinner plans with your date, and you suggest Italian and she states her preference would be a meal of tire rims and anthrax. If you can figure out a way to split the difference there and find a meal you will both enjoy, you can probably figure out how bipartisanship is going to work the next few years.

The United States never had a debt ceiling until 1939, and doesn’t need one now. Congress can control debt by its control over revenues and expenditures; all the debt ceiling does is create the possibility that the government will not be able to borrow the money needed to carry out the laws Congress has already passed.

Give the utter lack of any unified message on the issue, it’s genuinely remarkable that public opinion has turned so mightily in favor of what you could broadly call the “Obama position” on the debt ceiling. People still don’t seem to grasp what the hell the debt ceiling is or what purpose, if any, that it serves… but they’re beginning to dislike GOP demagoguery on it no matter what. At least we’ve got that going for us.

Esoterica

If this is your first time reading an Ars Technica review of Mac OS X and you’ve made it this far, be warned: this section will be even more esoteric than the ones you’ve already read.

John Siracusa, writing on page 9 of his always essential and insightful Mac OS X (now at version 10.7) review. Which, oh by the way, was released today alongside the new system. Silence grips Apple deathwatch, indeed.

Again with the Gangs

Steve Benen reports that the Gang of Six, er, Five, er, Six, er five plus Coburn who left but is back again is claiming to have come to terms on a broad budget agreement:

Coburn … noted the Congressional Budget Office would score the plan as a $1.5 trillion tax cut because it would eliminate the Alternative Minimum Tax. It would generate a significant amount of revenue out of tax reform and reduction of tax rates, which authors believe would spur economic growth.

Ah. So we’re going to eliminate the AMT, apparently without paying for it (because when has any gang ever actually paid for something), further cut other tax rates, and then, magically, revenues will just rise and rise. Just like they’ve never done in the past. At least we’re finally getting the serious people together over the kitchen table, as it were. Now if we can just placate the unicorn caucus and raise the ceiling to eleventy trillion billion dollars, we’ll have a deal.

In the same way that Wall Street hoovering up a third of all corporate profits is the new normal. Or that 9% unemployment is the new normal. Or that obstruction, rather than legislation, is the new normal for Congress. Or that massive spending cuts during a recession is the new normal. Or that conducting three overseas wars at the same time is the new normal.

The new normal kind of sucks, doesn’t it?

I think this phenomenon, more than anything explains why we’re going to default. Maybe not this time, but sooner than later. And even then, in the economic ruins that follow, there’s only a passing chance that the important lesson, the moral of the story will sink in.

More likely it’ll be blamed on ACORN, the EPA, and dread socialist fifth columnists and so forth. But I just don’t see how the boil gets lanced without the paroxysm. And, even then, the end result may be that the boil is simply inflamed further.

Dean Baker AND Ron Paul

An interesting read in which Dean Baker agrees with Ron Paul’s idea:

…the Fed has bought roughly $1.6 trillion in government bonds through its various quantitative easing programs over the last two and a half years. This money is part of the $14.3 trillion debt that is subject to the debt ceiling. However, the Fed is an agency of the government. Its assets are in fact assets of the government. Each year, the Fed refunds the interest earned on its assets in excess of the money needed to cover its operating expenses. Last year the Fed refunded almost $80 billion to the Treasury. In this sense, the bonds held by the Fed are literally money that the government owes to itself.

Unlike the debt held by Social Security, the debt held by the Fed is not tied to any specific obligations. The bonds held by the Fed are assets of the Fed. It has no obligations that it must use these assets to meet. There is no one who loses their retirement income if the Fed doesn’t have its bonds. In fact, there is no direct loss of income to anyone associated with the Fed’s destruction of its bonds. This means that if Congress told the Fed to burn the bonds, it would in effect just be destroying a liability that the government had to itself, but it would still reduce the debt subject to the debt ceiling by $1.6 trillion. This would buy the country considerable breathing room before the debt ceiling had to be raised again. President Obama and the Republican congressional leadership could have close to two years to talk about potential spending cuts or tax increases. Maybe they could even talk a little about jobs.

In addition, there’s a second reason why Representative Paul’s plan is such a good idea. As it stands now, the Fed plans to sell off its bond holdings over the next few years. This means that the interest paid on these bonds would go to banks, corporations, pension funds, and individual investors who purchase them from the Fed. In this case, the interest payments would be a burden to the Treasury since the Fed would no longer be collecting (and refunding) the interest.

More detail at the link. I’m no economist, but it sounds like dodging the interest alone is worth doing in exchange for a fairly minor “bank tax” down the road as the reserve rate requirements would necessarily ratcheted up slightly to offset the eventual inflationary pressure caused by The Great Bond Shredding of ‘11.

Were I Obama, I’d get out on the hustings this very second talking about how under no circumstances should the Fed order these bonds be destroyed. Go have lunch with Joe Biden. Come back out and say “well, it is with a heavy heart I have to bow to the demands of my GOP overlords. We shall shred the bonds effective immediately. Bipartisan!”

After all, the only way to get something done in this government is for Obama to come out against it and wait for the GOP’s reflexive adoption of the opposite position no matter what the issue. That the Democratic leadership in DC haven’t yet figured this out is why they fail.