The first solution [for the Great Depression] that occurred to statesmen was to propose tightening of belts, acceptance of hardship, resort to patience. Few can believe that suffering, especially by others, is in vain. Anything that is disagreeable must surely have beneficial economic effects.

[…]

People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right. The sensitivity of the poor to injustice is a trivial thing compared with that of the rich.

Tag: Depression II

In the same way that Wall Street hoovering up a third of all corporate profits is the new normal. Or that 9% unemployment is the new normal. Or that obstruction, rather than legislation, is the new normal for Congress. Or that massive spending cuts during a recession is the new normal. Or that conducting three overseas wars at the same time is the new normal.

The new normal kind of sucks, doesn’t it?

I think this phenomenon, more than anything explains why we’re going to default. Maybe not this time, but sooner than later. And even then, in the economic ruins that follow, there’s only a passing chance that the important lesson, the moral of the story will sink in.

More likely it’ll be blamed on ACORN, the EPA, and dread socialist fifth columnists and so forth. But I just don’t see how the boil gets lanced without the paroxysm. And, even then, the end result may be that the boil is simply inflamed further.

There is no intrinsic contradiction between providing additional fiscal stimulus today, while the unemployment rate is high and many factories and offices are underused, and imposing fiscal restraint several years from now, when output and employment will probably be close to their potential.

Please print out in the largest font convenient and post along with a similarly dimensioned sign saying Money is not real

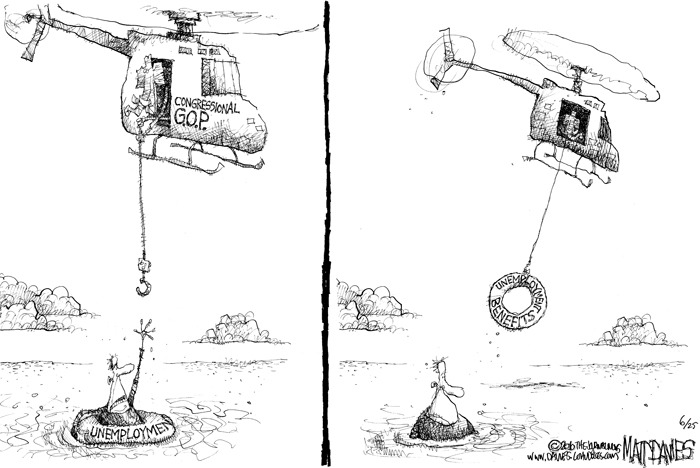

The Unemployed can Go Die in the Streets

In which thebroadermarket summarizes a theoretical, GOP-derived wonderland that we here at Lemkin refer to as “Go Die in the Streets”:

Thus, one is left with a situation in which the unemployed would find few opportunities for work, while simultaneously seeing their social safety net dry up. Meanwhile, the lucky employed would see the security of their labor jeopardized at the expense of allowing the financial marketplace to continue to operate relatively uninhibited. I am not one prone to hyperbole, but this just seems like a raw deal.

I am prone to hyperbole. But that would be shrill.

In the first phase, the financial crisis, the government screamed, and did everything it could to rescue the economy. In the second phase, when the financial crisis became a demand crisis, the public screamed, and the government did quite a lot – though not enough – to help. But as the demand crisis reveals itself as a persistent jobs crisis – the third phase – we’re getting used to it, and Senate Republicans are turning their attention to the midterms, [and] we just settle into a new, awful, and unnecessary normal.

The Plan

Ezra Klein notes the outcome of some polling on what the average American thinks should be done:

1. Raise the limit on taxable earnings so it covers 90% of total earnings.

2. Reduce spending on health care and non-defense discretionary spending by at least 5%.

3. Raise tax rates on corporate income and those earning more than $1 million.

4. Raise the age for receiving full Social Security benefits to 69.

5. Reduce defense spending by 10% – 15%.

6. Create a carbon and securities-transaction tax.

I don’t see any of these that are antithetical to the broad strokes of Democratic policy, at least as it has played out under Obama. Plus, these are the popular ideas. So steal them. This should be the Aims for a Renewed America (or whatever). You run on it across the board. Individual candidates may feel free to leaven in some Wall St. Fatcat mentions such that they can play down #4.

You’ve already allowed the Republicans to devestate whatever recovery there was…you’d damned well better have a platform that, in a stroke, both recognizes that we have a serious problem and outlines real, substantive, measurable ways to address it. Starting our First Day back in the Congress.

You got a better idea, Reid? Didn’t think so.

We are now, I fear, in the early stages of a third depression. It will probably look more like the Long Depression than the much more severe Great Depression. But the cost — to the world economy and, above all, to the millions of lives blighted by the absence of jobs — will nonetheless be immense.

And this third depression will be primarily a failure of policy. Around the world — most recently at last weekend’s deeply discouraging G-20 meeting — governments are obsessing about inflation when the real threat is deflation, preaching the need for belt-tightening when the real problem is inadequate spending.

I’d agree with all that Krugman says above (and in the editorial), but take small issue with this part:

In the face of this grim picture, you might have expected policy makers to realize that they haven’t yet done enough to promote recovery.

I think the GOP leadership realizes all too well that not enough has been done. They have chosen to use the crisis for short-term political gain. There is no other explanation for the withdrawal of unemployment benefits. None. They just want to maximize pain to the citizens out there that may be inclined to vote come 2010 and, more urgently from the GOP perspective, in the 2012 follow-on when they could well be poised to take power in both branches.

Then, of course, they’ll fix it all with a rigorous program of tax cuts for the wealthy. Which is touched on in the closer:

And who will pay the price for this triumph of orthodoxy? The answer is, tens of millions of unemployed workers, many of whom will go jobless for years, and some of whom will never work again.

Yep.

HFT demonstrably does not provide liquidity unless the market is going up and has market-wrecking implications. This is to say nothing about the advantages it gives institutional traders over non-HFT firms or individuals.

reblogging nonolet

This strikes me as the critical truth of the recent craziness, and one that I’ve not heard uttered by anyone at any level of the MSM, who were almost universally still peddling various demonstrably false interpretations.

tl;dr: We are fucked