The issue is, who pays when banks make a bad decision — the banks or the taxyapers? Republicans want the taxpayers on the hook. They support business as usual on Wall Street, which means having taxpayers bail out the banks, rather than holding the banks accountable for their own mistakes.

Tag: Depression II

Resolution 9

Mark Warner (D-Va.) discusses the early talking points surrounding the financial reform package:

If you haven’t spent time with these issues,“ Warner sighed, "it’s easy to pop off with sound-bite solutions that don’t work.”

Indeed it is. And that’s exactly what the GOP plans to do. And they’re already doing it; they have likely already won the framing war. Compare and contrast these statements from GOP fucktard in chief, Mitch McConnell

“We cannot allow endless taxpayer-funded bailouts for big Wall Street banks. And that’s why we must not pass the financial reform bill that’s about to hit the floor.”

-and-

“[The Dodd bill] gives the government a new backdoor mechanism for propping up failing or failed institutions…. We won’t solve this problem until the biggest banks are allowed to fail.”

with these (all from Warner):

“It appears that the Republican leader either doesn’t understand or chooses not to understand the basic underlying premise of what this bill puts in place.”

“Resolution will be so painful for any company. No rational management team would ever choose resolution. It means shareholders wiped out. Management wiped out. Your firm is going away. At least in bankruptcy, there was some chance that some of your equity would’ve been retained and you could come out in some form on the other side of the process. The resolution that [GOP Sen Bob] Corker and I have tried to create means the death of the company. The institution is gone.

Sen. Richard Shelby, the ranking Republican on the Banking Committee, refers to the resolution authority as:

a "slush fund”

-and-

“the mere existence of this [slush] fund will make it all too easy to choose a bailout over bankruptcy.”

Warner counters:

“Again, it’s either that they don’t understand or they choose not to understand. There’s nobody in the financial sector who believes this. They’d laugh at the proposition that $50 billion is enough to get you through the resolution process if a couple of firms go down. What we’ve heard time and again is that the challenge in a crisis is to buy enough time to keep the lights on for a few days till you get the FDIC in here. You could make it smaller. Corker and I spoke about $25 billion. But this is funded by the industry.”

“And here’s the hypocrisy of the Republican leader’s comments, I can guarantee you that if there had not been some pre-funding, the critique would’ve been: ‘Look at these guys! They’ve left the taxpayers exposed! What’s going to keep the lights on for these few days? It’s going to be Treasury funds or Federal Reserve funds. The taxpayer will be exposed!’ ”

You are goddamned right they would. But that’s not the point. As usual, the Democrat has a nuanced, sober take on the way forward. The GOP has a short, meaningless slogan that offers no policy insight or suggestion whatever. It’s just "go die in the streets” pointed at their corporate paymasters. Of course, both parties know such an event would never be allowed to transpire, so all’s well.

What the Democrat should be saying:

The GOP wants to help these fatcats to the punchbowl. Again

The GOP is lining the pockets of the bankers and guaranteeing future bailouts

Why is the GOP against prosecuting the worst of the Wall Street offenses? Why do they want to perpetuate the boom/bust cycle that benefits only the richest few?

And etc… Rest assured you’ll hear none of those in the run-up to 2010. Attempts at financial reform will fail. The next economic meltdown will happen sooner rather than later and find an American government that’s financially unable to do anything about it. Depression II will make the current recession seem like the good old days. And will be blamed on Obama. Wait and see.

At last: divergence. Must be all the GOP gainsaying that’s bringing output around.

The John Erwin Act of 2009

Based off the warm reception the recent AIG retention bonuses have received, I forsee no problem at all for Fannie and Freddie’s upcoming round of same.

Here’s what it’s going to take. First, enact the previous post. Up it to 200%, just to be sure, and include any corporation receiving bailout or TARP monies. Funny how the UAW had to reopen their contracts lest the world surely end, but the millionaires: not so much.

Second, an example needs to be made. Ceterum censeo AIG esse delendam. Starting immediately, AIG shall be taken into bankruptcy. The still very valuable and profitable insurance branch: sold off…on the condition that all its related executives must not be retained beyond six months. Their jobs are over. The dread CDS unit: what’s sellable is sold. As to the rest of it, the various counterparties will be approached, and workarounds “negotiated.” I’m pretty sure their attidues will soften once the default swap is going to yield a) something -or- b) zero (with the attendant and required revelation on the old balance sheet). What’s not unwindable or proves unsellable is held by a resolution trust-style operation and eventually sold. Everyone, and I mean everyone currently employed by AIG that makes above $100,000/yr: goes on the fucking breadline. You can safely fire everyone not in the insurance unit starting tomorrow. And you furthermore ensure that they are not legally employable by any company or proxy of said company that is receiving or received bailout or TARP funds.

Then we wait and see which CEO wants to start off the next round of bonuses for all the hard work and genius. Things have changed. Dramatically. These fucktards just refuse to accept it.

And, media, can we quit with all the “Masters of the Universe” crap? It was foolish and obviously quite sad when times were good. Now it’s just pathetic.

100%

Resolved: There shall be a 100% tax on all bonuses, remunerations, inducements, extras, fees, and any other income not classified as “regular” (tax code here) on all employees of AIG for fiscal years through and including 2010.

Resolved: Regular incomes in excess of $50,233.00 shall be taxed at 50% in each of those years for any employee of any institution receiving TARP funds. This shall include all meals, airline flights, club memberships, cars or car services, homes, and any other indirect income received as part of an overall “compensation package” by any individual so employed.

The fucking end. Are you listening, Congress?

Are we really meant to believe that retention bonuses for the very same fucking idiots that crushed the global markets are absolutely required to keep these same “best and brightest” around long enough to fix what they hath wrought? Unbelievable.

This has all happened before…

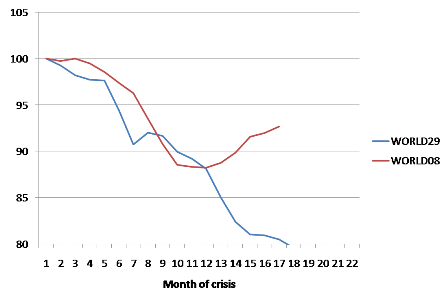

Chart of the day (from here). So then, 1929 it is. I guess we can all look forward to 2028 when things really get going again…

On the plus side, the article closes with this tidbit:

It is going to be a buying opportunity of the century.

At least we’ve got that going for us. That and the long awaited chance to start stockpiling yer gold.

DOW 0

Reliably predicting events even a few days in the future is never easy. But this time, I think it’s pretty obviously straightforward. Lead-pipe domain. Assuming a continued steady and daily 500 point drop in the Dow Jones Industrial Index (which is looking pretty optimistic at this point) when will we finally reach Dow=0?

Why, on November 4th, of course. When else could it possibly happen?

I expect CNN and others to have some “Countdown to 0!!!” graphics up by the afternoon.

Ceterum censeo GOP esse delendam

David Brooks, the man who (uh, more or less) admits to covering for John McCain these past ten long years, is officially off the bus with regard to the bleeding edge (circa 1984) economic and geopolitical thinking of the current GOP:

It has been interesting to watch them on their single-minded mission to destroy the Republican Party. Not long ago, they led an anti-immigration crusade that drove away Hispanic support. Then, too, they listened to the loudest and angriest voices in their party, oblivious to the complicated anxieties that lurk in most American minds.

Now they have once again confused talk radio with reality. If this economy slides, they will go down in history as the Smoot-Hawleys of the 21st century. With this vote, they’ve taken responsibility for this economy, and they will be held accountable. The short-term blows will fall on John McCain, the long-term stress on the existence of the G.O.P. as we know it.

I’ve spoken with several House Republicans over the past few days and most admirably believe in free-market principles. What’s sad is that they still think it’s 1984. They still think the biggest threat comes from socialism and Walter Mondale liberalism. They seem not to have noticed how global capital flows have transformed our political economy.

Every now and then, even a blind pig finds a nut. He then applies lipstick with it. Badly:

What we need in this situation is authority. Not heavy-handed government regulation, but the steady and powerful hand of some public institutions that can guard against the corrupting influences of sloppy money and then prevent destructive contagions when the credit dries up.

Er, okay, David. We’ll have some non-regulating regulations out for you by lunch. Nice talking to you.

The real conclusion is reached by Brad DeLong:

This Republican Party needs to be burned, razed to the ground, and the furrows sown with salt…

Yep. Methinks this is the end of the beginning of the end of the current political structure. Whether or not the GOP will be a part of what follows depends heavily on the next few weeks and months.

Why the bile? Why especially now? Perhaps this has something to do with it:

[NBC’s Andrea Mitchell reported that] leading Republicans who are close to [Newt Gingrich said] he was whipping against this up until the last minute when he issued that face-saving statement [claiming he was in favor of the bailout bill]. Newt Gingrich was telling people in the strongest possible language that this was a terrible deal, not only that it was a terrible deal, that it was a disaster, it was the end of democracy as we know it, it was socialism. And then at the last minute comes out with a statement when the vote is already in place.

[…]

NBC’s Mike Barnicle said he had been told by congressional conservatives that the move was “the opening salvo of Newt Gingrich’s presidential campaign four years hence.”

Cynicism, thy name be Newt. Where’s Ross Perot and some pie-charts when you need him? Let’s hope there’s a recognizable country left for one of them to run into the ground come 2012.

We ought to route him into Lake Michigan, at least we’ll avoid killing innocent people.

Looks like the GOP is taking its own advice. ~60% of them voted against the bailout bill. The Dow promptly closed down 777 points. Tomorrow, it would seem, is when the shit really hits the fan:

…new worries were building inside the nearly $2 trillion world of hedge funds. After years of explosive growth, losses are mounting — and so are concerns that some investors will head for the exits.

….The big worry is that a spate of hurried sales could unleash a vicious circle within the hedge fund industry, with the sales leading to more losses, and those losses leading to more withdrawals, and so on. A big test will come on Tuesday, when many funds are scheduled to accept withdrawal requests for the end of the year.

“Everybody’s watching for redemptions,” said James McKee, director of hedge fund research at Callan Associates, a consulting firm in San Francisco. “And there could be a cascading effect, where redemptions cause other redemptions.”

All over but the crying. It’s been a good run. Man on the moon, and all that. Somebody turn the lights out on the way out the door. Krugman notes there’s no parking in the White Zone.