Even as the political battle mounts over federal spending, the end result for federal policy is already visible — and clearly favors Republican goals of deep spending cuts and drastically fewer government services.

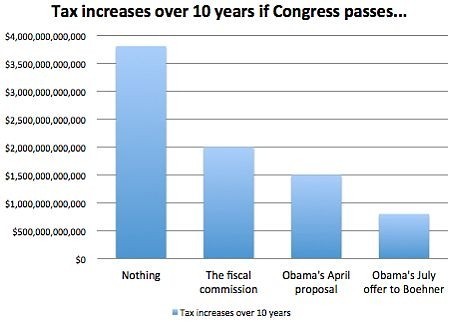

President Obama entered the fray last week to insist that federal deficits can’t be reduced through spending reductions alone. Federal tax revenue also must rise as part of whatever deficit reduction package Congress approves this summer, he said. Obama has been pushing to end a series of what he calls tax loopholes and tax breaks for the rich.

But even if Obama were to gain all the tax-law changes he wants, new revenue would make up only about 15 cents of each dollar in deficit reduction in the package. An agreement by the Republicans to accept new revenue would be a political victory for Obama because “no new taxes” has been such an article of faith for the GOP.

I think this analysis leaves out a critical piece of the calculation: the December 2012 expiration of the Bush tax cuts. Recall that Obama, above all else, is the “outcomes” President. He’s more than willing to take a temporary political setback or even a seeming political loss in the short term if that in turn leads to the long-term policy outcomes he prefers.

So: to get a deal on the debt ceiling he gives the GOP a fatter ratio of cuts to revenues for now. Keep in mind, these “cuts” are really a framework that then plays out over most of a decade and will ultimately be changed and tuned by several Presidents and Congresses (and that’s assuming they stick to the framework at all).

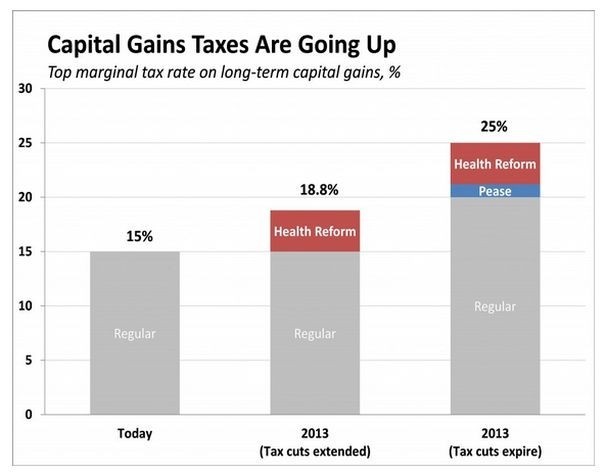

Next year though, assuming Obama’s reelected, everything changes on the revenue front. If the Congress simply fails to act, the full set of cuts expires. If they act, but the GOP includes extension of the cuts for those making more than ~$200k/yr, Obama vetoes it. And, really, if we assume that the GOP will fail in its efforts to destroy the economy in the next few weeks, Obama likely prefers one of those two outcomes. Why? Again, it’s because they are the best long-term outcomes for the country. That both reflect poorly on the GOP is a bonus side benefit going into the 2014 midterms. To be sure, a tax rise represents real short term pain for the less well off, but that pain yields long term stability and, let’s face it, sanity in the revenue structures of the United States.

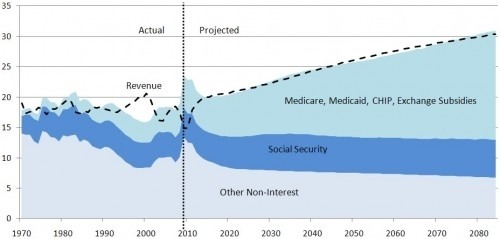

Expiration of the Bush tax cuts is a key pillar in the “do nothing” solution for our current deficit/revenue issues. The assumption that all or most of them are going to expire if Obama is reelected needs to be included in any meaningful political calculus regarding the ratio of cuts to revenue increases in the current negotiation. Assuming expiration, you ultimately end up with a number of difficult but doable fixes that can be handled one at a time. If those “fixes” are, you know, paid for, the country will once again be on firm financial footing, complete with a reasonably robust social safety net for as far as the eye can see. This is precisely the outcome Obama is playing for.

Obama’s Other Card