Across several posts, Dean Baker lays into the dread Liberal Media for just plain making it up when it comes to pushing their preferred, center-right “cut deficits now” agenda.

“The national debt will exceed the size of the entire U.S. economy by 2021 — and balloon to nearly 200 percent of GDP within 25 years — without dramatic cuts to federal health and retirement programs or steep tax increases, congressional budget analysts said Wednesday.”

Actually, this is not what the projections showed. The CBO projections showed that if Congress simply followed current law, letting the Bush tax cuts expire, not fixing the alternative minimum tax, and most importantly, allowing the spending caps in the Affordable Care Act (ACA) to remain in place, then the debt to GDP ratio will soon stabilize and head downwards.

“The national debt is on pace to equal the annual size of the economy within a decade, levels that could provoke a European-style crisis unless policymakers take action on the federal deficit, according to a report by the Congressional Budget Office.”

This is not true. The CBO report did not warn of “a European-style crisis.” The reason it did not is that a European style crisis does not make sense in the context of the United States. The United States can never be like Greece or Ireland for the simply reason that we print out own currency.

In the event that we actually ran up against serious constraints in credit markets the United States would have the option to have the Fed buy up its debt. Greece and Ireland do not have this option. This could create a risk of inflation, but there is not the risk of insolvency that euro zone governments face.

In the top of the hour news segment on Morning Edition, NPR told listeners that the Congressional Budget Office warned that the national debt will soon equal the annual size of the economy and this could lead to a European-style crisis [see: New York Times above].

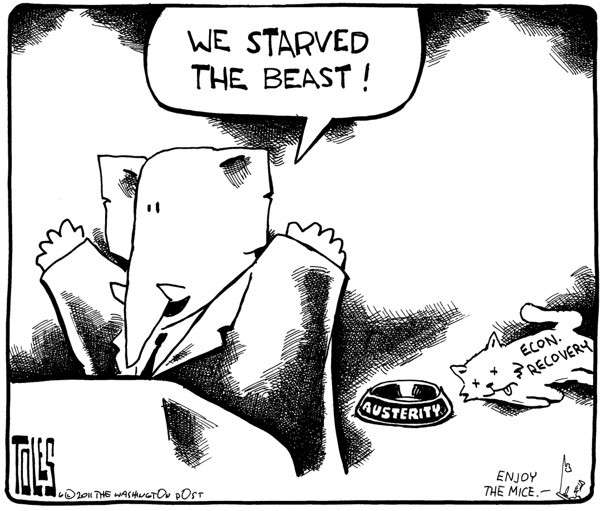

This is critically important stuff. Deep cuts right now will strangle the economy and deeply hurt Obama’s chance at reelection to boot. This, coupled with the knowledge that as conditions improve, the ability (in the form of public desire) to make huge cuts to the social safety net will diminish precipitously is precisely why the GOP is for deep cuts now. They know that doing nothing and simply letting the Bush tax cuts expire will do more for improved deficits than almost any of the “plans” on the table. The CBO has said so again and again. These “plans” are not and never will be about the deficit. They are about pushing a preferred social agenda. Period. We just can’t get anyone in the media to break free from their “view from nowhere, compromise must always be the preferable, serious person postion” lens for long enough to get them to even report the simple facts of the case at hand.

tl;dr: We’re doomed. There will be a default. Maybe not this time, but soon. Once you’ve set up the terms of debate such that they always include wrangling over lifting the debt ceiling and treating it essentially as a hostage situation, then you’ve created a system that, sooner or later, someone will push too far for their own purely political purposes. And when that happens it will be the end of America as we’ve known it. And I suspect that will be happening pretty damned soon.