Kevin Drum wonders what drives Ryan to produce such a uniquely partisan budget document…

There is this strange notion that Ryan should not have proposed the plan he actually wanted, but that he was supposed to compromise before the Democrats even come to the table. This is insane. You don’t go to the car dealer and figure, “Well, I’d like to pay $22,000 for the Prius, but he’d probably like me to pay more, so I’ll start at $23,000.” Ryan proposed the plan he wanted; the Democrats are now free to counter with any plan of their choosing, and maybe the sides will meet somewhere in the middle.

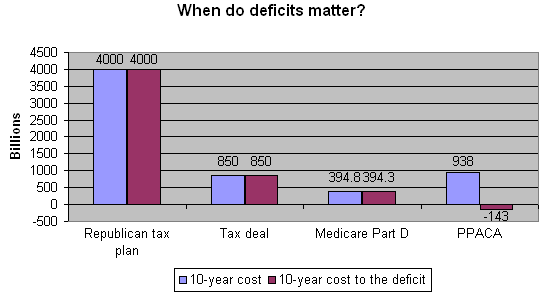

So what’s the problem here? The problem is that Democrats don’t want to address the debt problem because it means they will either have to sacrifice programs they like or greatly increase taxes on the middle class. There’s nothing fun about that choice, but Paul Ryan didn’t put us into the position where that choice has to be made.

Perhaps I wasn’t sufficiently clear: of course Ryan should swing for the fences. My frustration lies with the traditional Democratic impulse to start from the position of compromise in response to said fence-swinging proposal. They’ve know he was developing this plan, and the outlines of it, for weeks. In response, they’ve been working on marking up the deficit commission’s plan. My contention is that this is bad strategy unless you want a rightward shift in funding priorities.

But, I don’t consider returning to Clintonian tax rates “greatly increasing” taxes on anybody. Let the Bush tax cuts expire. Period. In a stroke, you’ve corrected at least half of the deficit issue. You can legitimately plan to make reasonable cuts and adjustments and but also just grow your way out of the rest of it, as the economy should be in much better shape by the time of that expiry.