Clinton: Or maybe he doesn’t want the American people, all of you watching tonight, to know that he’s paid nothing in federal taxes, because the only years that anybody’s ever seen were a couple of years when he had to turn them over to state authorities when he was trying to get a casino license, and they showed he didn’t pay any federal income tax.

TRUMP: That makes me smart.

Lemkin: For some reason, I expect to see this exchange in continuous ad rotation right up until blood starts coming from my eyes and or my whatever.

Tag: taxes

Mandate Upheld

SCOTUSblog reporting mandate deemed tax, upheld. Roberts apparently joins “left” of court on that.

Compare and contrast with this exchange on NPR yesterday (emphasis added):

[NPR’s Melissa] BLOCK: Let’s move on to the budget questions that are pending here. You sent a rather lengthy letter to the Defense Secretary Leon Panetta about a month ago, making the case for the Marine Corps in a time of, what you called, considerable fiscal austerity. And the message to Secretary Panetta seemed to be, as you’re slicing an ever small, an ever shrinking pie, protect us, protect the Marines. I wonder if this becomes a battle essentially among the service branches of who is most worthy. And if that is the battle, what’s the case from the Marines?

[Marine Corps Commandant General James] AMOS: Well, I think in anybody budget crisis – when you’ve got multiple services – in some cases, it can relegate into roles or missions. In other words, what’s the role of this service, the mission of this service? I think it can happen that way. And if you’re not careful, it can break out probably the worst of behavior.

So, what I was really trying to say is that as we come down and reduce capabilities and capacity in our nation, one of the ways that you can – and you assume a level of risk when you do that. You know, we’re going from what we are down to something less. When that happens, how do you mitigate the risk?

Indeed, it’s going to take a lot of risk mitigation to even begin thinking about some smallish cuts to this budget. And but also: this is what they call a “budget crisis” and “considerable financial austerity.”

Ryan’s Motivations (or: Pie-O-My)

Kevin Drum wonders what drives Ryan to produce such a uniquely partisan budget document…

There is this strange notion that Ryan should not have proposed the plan he actually wanted, but that he was supposed to compromise before the Democrats even come to the table. This is insane. You don’t go to the car dealer and figure, “Well, I’d like to pay $22,000 for the Prius, but he’d probably like me to pay more, so I’ll start at $23,000.” Ryan proposed the plan he wanted; the Democrats are now free to counter with any plan of their choosing, and maybe the sides will meet somewhere in the middle.

So what’s the problem here? The problem is that Democrats don’t want to address the debt problem because it means they will either have to sacrifice programs they like or greatly increase taxes on the middle class. There’s nothing fun about that choice, but Paul Ryan didn’t put us into the position where that choice has to be made.

Perhaps I wasn’t sufficiently clear: of course Ryan should swing for the fences. My frustration lies with the traditional Democratic impulse to start from the position of compromise in response to said fence-swinging proposal. They’ve know he was developing this plan, and the outlines of it, for weeks. In response, they’ve been working on marking up the deficit commission’s plan. My contention is that this is bad strategy unless you want a rightward shift in funding priorities.

But, I don’t consider returning to Clintonian tax rates “greatly increasing” taxes on anybody. Let the Bush tax cuts expire. Period. In a stroke, you’ve corrected at least half of the deficit issue. You can legitimately plan to make reasonable cuts and adjustments and but also just grow your way out of the rest of it, as the economy should be in much better shape by the time of that expiry.

Your Federal Tax Receipt

This should be an automatic part of every single tax return. In fact, tax returns should be so simple that they can be entirely collected by employers with no further action on the part of the vast majority of taxpayers and then said receipt arrives in the form of a post card with your information, where the money is going, and basic information on how to proceed if you think the card’s data is wrong.

Naturally, it is in Congress’ interest to keep tax returns complex (the better to use internecine complexities such that they can make what appear to be juicy carve-outs for all parties) and in the GOP’s interest to maximize both the overall sense of taxpayer outrage at the difficulty and ridiculousness of it all, all the better to play their “ya done got robbed of your money, and for what?” broken record.

GOP: Party of Compromise

Greg Sargent talks Bush tax cuts and GOP/Democratic comity and compromise:

There is a way a one-year or two-year temporary extension could represent a compromise of sorts: If Republicans signal a willingness to at least entertain the idea of letting the high end cuts expire after that temporary extension. But many of them aren’t doing that. Their position is that the high-end cuts need to be made permanent. Full stop.

Exactly right. The GOP idea of compromise here is permanent Bush tax cuts. I suspect they might be willing to dump the tax cuts for the bottom 99% of America, but that top 1% isn’t going anywhere and they don’t want some two-year fix, they want it made permanent.

Democrats need to get through their heads that losing the entire Bush tax cuts package is actually the best long-term policy outcome; that this is also the “no deal, time expires” outcome makes it all the more powerful as a bargaining chip. Always be willing to walk away from the entire thing, and always make clear that all blame rests on the GOP by making clear that full-extension is their position, so partial repeal is the compromise position. Yes, walking away means short term harm to everyone making below $250k/yr, but if that’s what it takes to roll back the tax cuts for the richest of the rich: so be it. Only from that position of relative strength do you get the GOP to even approach the table. And, I’ll let you in on a secret: they still won’t.

This is why it’s the perfect issue for the Democrats. It’s important, easy to understand, and directly pits the hyper-rich against the interests of most Americans. Swing for the fences. You’ve got nothing to lose. If you force the GOP to accept short-term, top 1% cuts, it’s a win. If you force the media to face the fact that the GOP has zero interest in compromise on anything, it’s a win, and if you force the true compromise position of time-limited cuts for 99% of Americans and an immediate roll-back to Clinton-era rates for the top 1%: it’s a giant win of the sort that could redefine the terms and dimensions of exactly how policies do or don’t get done over the next two years. So why not try?

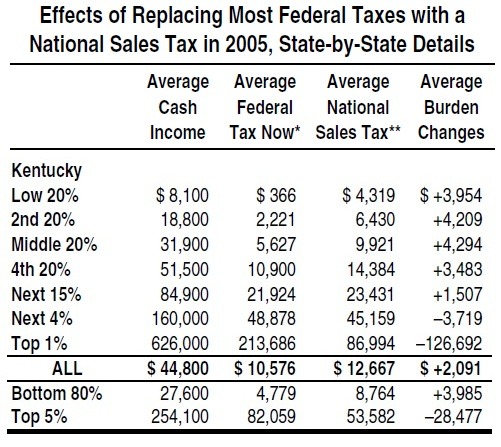

Effects of Replacing Most Federal Taxes with a National Sales Tax in 2005 (via)

But think of all the jobs it will make.

File under: yet another simple table The Democrat will never, ever use to make a larger point about GOP policies and those who would benefit from them.

S is for Senate

Steve Benen hears Boehner say this:

If the only option I have is to vote for some of those tax reductions, I’ll vote for them.

and, like seemingly everyone with a mountaintop large or small, inexplicably takes this away:

Boehner, in other words, appears to be on board with the Obama proposal

Can we just not think in this country anymore?

- Is Boehner in the Senate?

There is no second thing. If the answer to Question 1 is “No,” then his opinion matters fuck-all. He said this to put a patina of reasonableness on the GOP’s entirely unreasonable and indefensible position that billionaires desperately need an extra $100k come tax-time. They know this meaningless statement will get wide play, much wider (read: vastly wider) than their ultimate actions to bottle this thing up in the Senate (and even that’s assuming the feckless Democrat bothers to bring it to the floor, itself a gigantic and likely foolhardy assumption).

If and when that all happens, the GOP will simply point to (meaningless) statements like this one as examples of their genteel nature and broad willingness to “work across the aisle.” The MSM will report the whole thing as “a Democrat failure to achieve 60 votes needed in the Senate” and Broder will pronounce himself suitably delighted that the GOP tried so very hard. Truly, they are the serious adults up to DC.

Is this so very hard to understand? Apparently it is.

So the next question is simply, “What do the experts on your staff tell you that the top marginal tax rate should be in order to maximize tax revenues, leaving everything else about the tax code the same?” Journalists should relentlessly ask it of the Republican leadership in Congress who continue to make fallacious claims, and the Democratic leadership in Congress ought to ask it politely in a letter to CBO Director Doug Elmendorf.